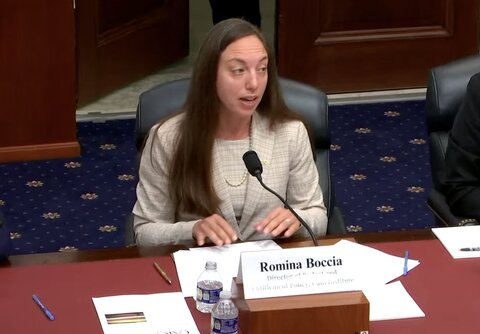

I recently testified before the Senate Finance Committee on the importance of personal savings and how poorly designed tax systems and social welfare programs keep many Americans from putting money away for the future. I highlighted universal savings accounts (USAs) as one important reform to help more Americans save for their own priorities.

You can read my full testimony here and watch it here.

The government shouldn’t subsidize or penalize savings. Responding to market incentives, individuals and businesses know best how much to save and invest when government policy doesn’t get in the way. What follows is an expansion of my comments on universal savings accounts as one way to reduce the government’s distortion of personal savings.

Traditional income tax systems encourage consumption over saving by assessing multiple layers of tax on interest and investment returns. Wages are first taxed by income and payroll taxes. Any saved income that increases in value is often taxed again by levies on interest, capital gains, dividends, and transfers at death. The corporate income tax adds another layer of tax on income earned from corporate equity investments. All these taxes reduce market incentives to save.

One way the tax code reduces the income tax systems’ built‐in bias against saving is through qualified savings accounts, such as employer‐administered 401(k) retirement accounts, Individual Retirement Accounts (IRAs), and 529 Plan education savings accounts. Qualified accounts remove individual‐level taxes on investments by allowing taxpayers to contribute tax‐deferred income (traditional accounts) or after‐tax income (Roth accounts) without any other taxes owed.

Table 1 shows an illustrative example of how the tax code can penalize savers. Tom and Dan are both 30 years old, in the 24 percent income tax bracket, and want to save $5,000 this year. Tom deposits $5,000 directly into his traditional 401(k) and receives a corresponding income tax deduction, saving him $1,200 in taxes this year. Dan also saved $5,000 of pre‐tax income this year but did not deposit it in a qualified savings account and paid $1,200 of income tax on his saved income. If Dan and Tom both earn the same 7 percent rate of return for 30 years, Tom will pay about $9,800 in taxes when he withdraws the savings, leaving him with $31,000. Dan only pays $4,600 in capital gains taxes when he sells his assets, but because his original seed money was smaller, he is left with $26,400 in after‐tax savings ($4,700 less than Tom). Tom’s marginal effective tax rate is 24 percent, and Dan’s is 35 percent.

Without qualified accounts, the income tax system increases the tax rate on Dan’s savings, discouraging him from setting money aside for the future. All else being equal, Dan will save less for retirement than Tom, and the broader economy will be poorer due to Dan’s missing contribution to the capital stock. Without protections from investment taxes, the same is true for other types of non‐retirement savings.

Universal Savings Accounts Expand Access

The existing qualified accounts shield taxpayers from double taxation, but they also come with income and contribution limits, age restrictions, employer requirements, required minimum distributions, and restrictions on what and when the savings can be spent. These rules are enforced with additional tax penalties and regulatory hurdles designed to increase the cost of accessing the savings for non‐qualified expenses. The complexity of this existing system and penalties for mistakes discourage uptake, especially among young and low‐income savers for whom liquidity is most important.

To fix this problem, Congress could create a universal savings account that would function similarly to retirement accounts—income saved in the account would only be taxed once—but without restrictions on who can contribute, on what the funds can be used for, or when they can be spent. Similar accounts have been set up in Canada, the United Kingdom, and South Africa, where they are wildly popular, have increased personal savings, and are used by people at every income level.

Cato’s Chris Edwards has been promoting the idea of USAs for some time. Writing with Ernest Christian in 2002, he laid out the case for an unrestricted universal savings account, and then in 2017, with Ryan Bourne, explained how such accounts were successful at promoting saving in Canada and the United Kingdom. In 2020, 40 percent of Canadian households contributed to a Canadian tax‐free savings account (TFSA)—almost 60 percent own a TFSA—and 51 percent of TFSA account holders earned less than Canadian $50,000 (about US $37,000).

In two recent pieces, the Tax Foundation has updated the case for USAs by looking at the most recent Canadian and UK data. Willliam McBride concludes that “Canada’s tax‐free savings accounts are a huge success,” and Garett Watson explains how the UK’s “individual savings accounts” should be a model for US policymakers “looking to encourage greater saving and financial security, particularly among low‐ and moderate‐income households.” Following this advice, the Heritage Foundation and the Republican Study Committee include universal savings accounts in their annual budget blueprints.

When economists and policymakers determine that an activity, like saving, is important, they tend to want to subsidize more of it. Instead of subsidizing personal savings, Congress should work to reduce existing disincentives to save in the tax code and other government programs. Universal savings accounts would encourage additional savings by reducing existing impediments to putting money away for all Americans.